Credit Risk Prediction#

This is a German credit risk dataset that can be found on Kaggle German Risk. My goal is to create a predictive model, use this model to generate a score for each client, and ultimately classify clients into risk profiles, differentiating between the riskiest and least risky

Introduction#

Context

Each person is classified as having good or bad credit risk according to the set of attributes. The selected attributes are:

Age (numeric)

Sex (text: male, female)

Job (numeric: 0 - unskilled and non-resident, 1 - unskilled and resident, 2 - skilled, 3 - highly skilled)

Housing (text: own, rent, or free)

Saving accounts (text - little, moderate, quite rich, rich)

Checking account (text - little, moderate, rich)

Credit amount (numeric, in DM)

Duration (numeric, in month)

Purpose(text: car, furniture/equipment, radio/TV, domestic appliances, repairs, education, business, vacation/others)

Risk (Value target - Good or Bad Risk)

The business team came to you because they want to understand the behavior and the profile of the most risk clients and our goal here is to create a predictive model to help them

My goal here is to create a prediction model. I’ll use Optuna for hyperparameter optimization then ‘rank’ the customer in scores and then use the shap to identify each variable as the most important

Dataset#

import numpy as np

import pandas as pd

import sys

import timeit

import gc

import sklearn

from sklearn.model_selection import KFold

import seaborn

from sklearn import metrics

from sklearn.metrics import confusion_matrix

from sklearn.model_selection import cross_val_score

from sklearn.model_selection import train_test_split

import lightgbm

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import RandomForestClassifier

from sklearn.linear_model import LogisticRegression

from sklearn.naive_bayes import GaussianNB

from sklearn.svm import SVC

from catboost import CatBoostClassifier

from xgboost import XGBClassifier

from lightgbm import LGBMClassifier

from sklearn.metrics import roc_auc_score

from sklearn.metrics import accuracy_score

import optuna

import matplotlib.pylab as plt

import seaborn as sns

import plotly.offline as py

py.init_notebook_mode(connected=True)

import plotly.graph_objs as go

import plotly.tools as tls

from collections import Counter

# read the dataset

df = pd.read_csv('german_credit_data.csv')

df

| Unnamed: 0 | Age | Sex | Job | Housing | Saving accounts | Checking account | Credit amount | Duration | Purpose | Risk | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 67 | male | 2 | own | NaN | little | 1169 | 6 | radio/TV | good |

| 1 | 1 | 22 | female | 2 | own | little | moderate | 5951 | 48 | radio/TV | bad |

| 2 | 2 | 49 | male | 1 | own | little | NaN | 2096 | 12 | education | good |

| 3 | 3 | 45 | male | 2 | free | little | little | 7882 | 42 | furniture/equipment | good |

| 4 | 4 | 53 | male | 2 | free | little | little | 4870 | 24 | car | bad |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 995 | 995 | 31 | female | 1 | own | little | NaN | 1736 | 12 | furniture/equipment | good |

| 996 | 996 | 40 | male | 3 | own | little | little | 3857 | 30 | car | good |

| 997 | 997 | 38 | male | 2 | own | little | NaN | 804 | 12 | radio/TV | good |

| 998 | 998 | 23 | male | 2 | free | little | little | 1845 | 45 | radio/TV | bad |

| 999 | 999 | 27 | male | 2 | own | moderate | moderate | 4576 | 45 | car | good |

1000 rows × 11 columns

Looking at the Type of Data

Null Numbers or/and Unique values

# knowing the shape of the data and search for missing

print(df.info())

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1000 entries, 0 to 999

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Unnamed: 0 1000 non-null int64

1 Age 1000 non-null int64

2 Sex 1000 non-null object

3 Job 1000 non-null int64

4 Housing 1000 non-null object

5 Saving accounts 817 non-null object

6 Checking account 606 non-null object

7 Credit amount 1000 non-null int64

8 Duration 1000 non-null int64

9 Purpose 1000 non-null object

10 Risk 1000 non-null object

dtypes: int64(5), object(6)

memory usage: 86.1+ KB

None

# looking unique values

print(df.nunique())

Unnamed: 0 1000

Age 53

Sex 2

Job 4

Housing 3

Saving accounts 4

Checking account 3

Credit amount 921

Duration 33

Purpose 8

Risk 2

dtype: int64

EDA#

Let’s start looking through the target variable and their distribution, here I’ll show only some variables that I thought they have some interesting distribution, to see the others look the Notebook in the GitHub Repository

df_age = df['Age'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Age'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Age'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_age,

histnorm='probability',

name="Overall Age"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Age",

xaxis = dict(title="Age")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

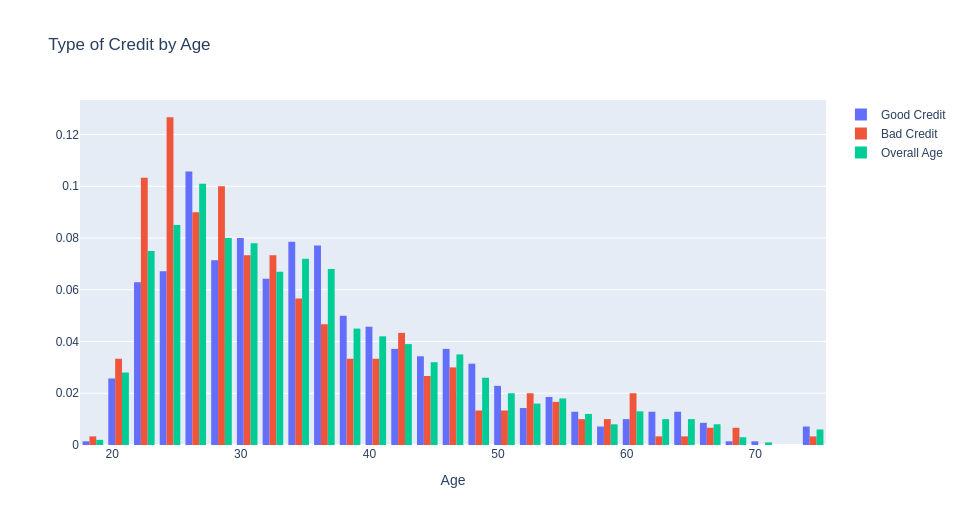

We can see that people with Bad Credit tend to more youth

We can see that people with Bad Credit tend to more youth

df_housing = df['Housing'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Housing'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Housing'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_housing,

histnorm='probability',

name="Overall Housing"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Housing",

xaxis = dict(title="Housing")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

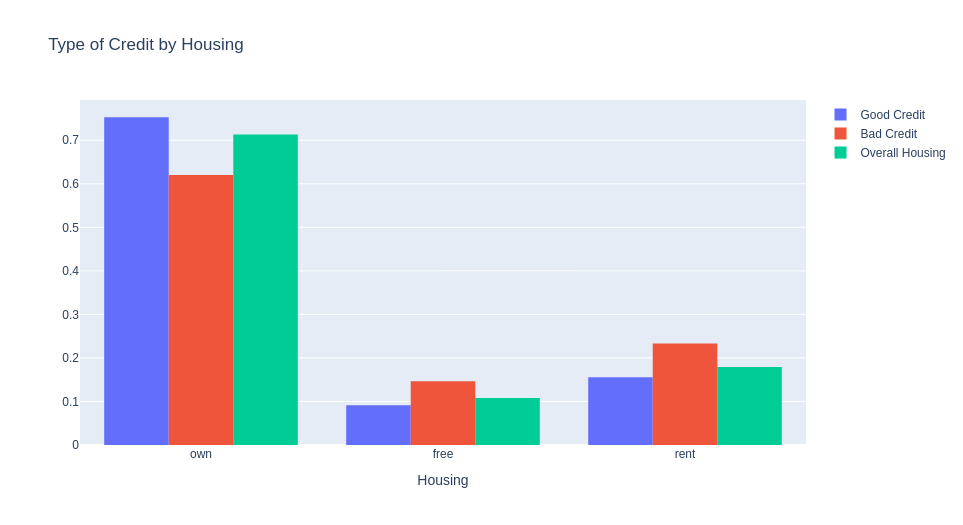

People who own a house have better credit.

People who own a house have better credit.

df_saving = df['Saving accounts'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Saving accounts'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Saving accounts'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_saving,

histnorm='probability',

name="Overall saving"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Saving",

xaxis = dict(title="Saving")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

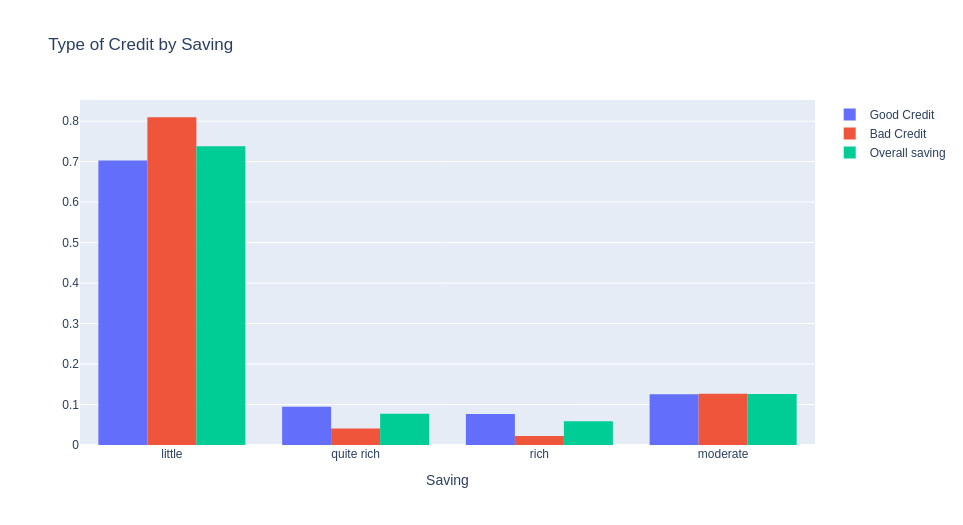

People with more savings accounts also have better credit

People with more savings accounts also have better credit

df_checking = df['Checking account'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Checking account'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Checking account'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_checking,

histnorm='probability',

name="Overall checking account"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Checking Account",

xaxis = dict(title="Checking Account")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

The same here, people with more checking account has better credit

df_credit = df['Credit amount'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Credit amount'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Credit amount'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_credit,

histnorm='probability',

name="Overall Credit amount"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Credit amount",

xaxis = dict(title="Credit amount")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

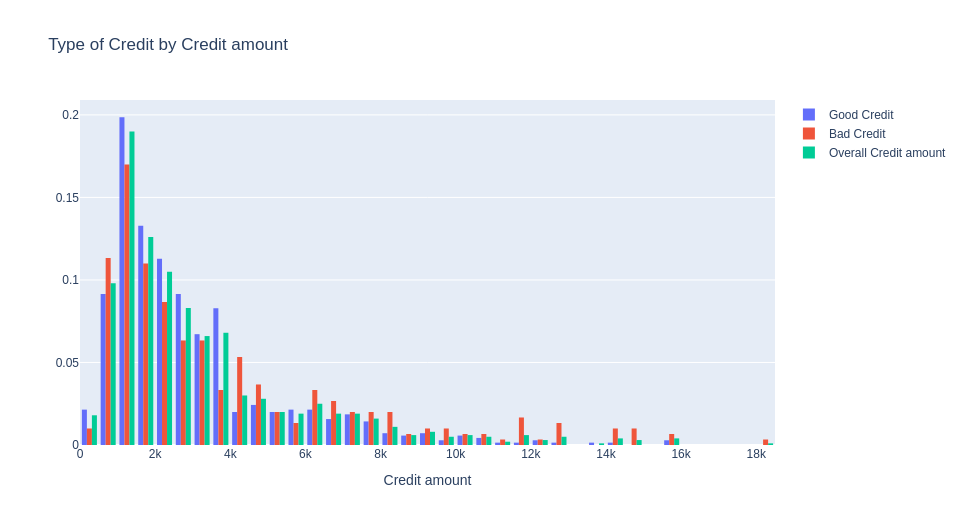

People with more than 4k in credit amount have worse credit than people with less

People with more than 4k in credit amount have worse credit than people with less

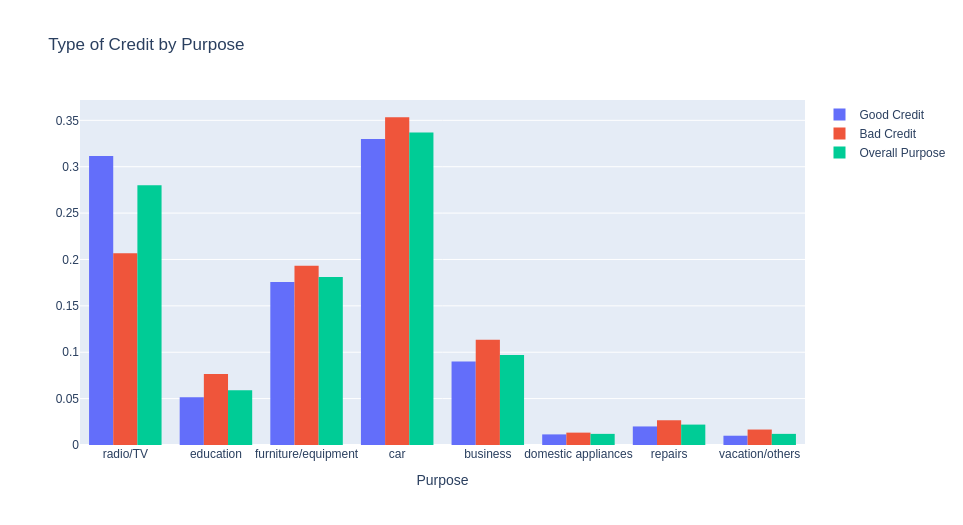

df_purpose = df['Purpose'].values.tolist()

df_good = df.loc[df["Risk"] == 'good']['Purpose'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Purpose'].values.tolist()

hist_1 = go.Histogram(

x=df_good,

histnorm='probability',

name="Good Credit"

)

hist_2 = go.Histogram(

x=df_bad,

histnorm='probability',

name="Bad Credit"

)

hist_3 = go.Histogram(

x=df_purpose,

histnorm='probability',

name="Overall Purpose"

)

data = [hist_1, hist_2, hist_3]

layout = dict(

title="Type of Credit by Purpose",

xaxis = dict(title="Purpose")

)

fig = dict(data=data, layout=layout)

py.iplot(fig, filename='custom-sized-subplot-with-subplot-titles')

People that the purpose is to buy radio/TV have a better credit

People that the purpose is to buy radio/TV have a better credit

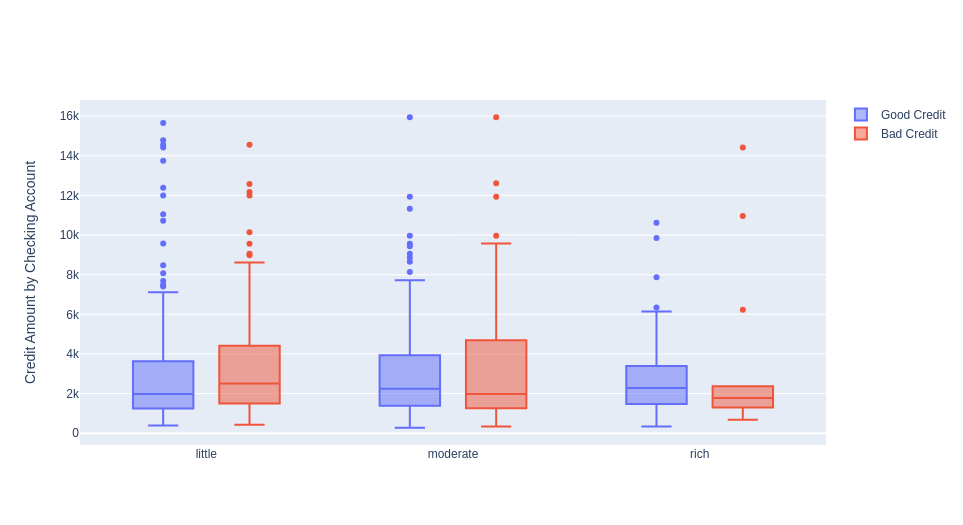

Now let’s see the distribution using two variables

df_good = df.loc[df["Risk"] == 'good']['Checking account'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Checking account'].values.tolist()

box_1 = go.Box(

x=df_good,

y=df['Credit amount'],

name="Good Credit"

)

box_2 = go.Box(

x=df_bad,

y=df['Credit amount'],

name="Bad Credit"

)

data = [box_1, box_2]

layout = go.Layout(

yaxis=dict(

title='Credit Amount by Checking Account'

),

boxmode='group'

)

fig = go.Figure(data=data, layout=layout)

py.iplot(fig, filename='box-age-cat')

The credit amount is also less in rich people (checking account), even in those bad credit

The credit amount is also less in rich people (checking account), even in those bad credit

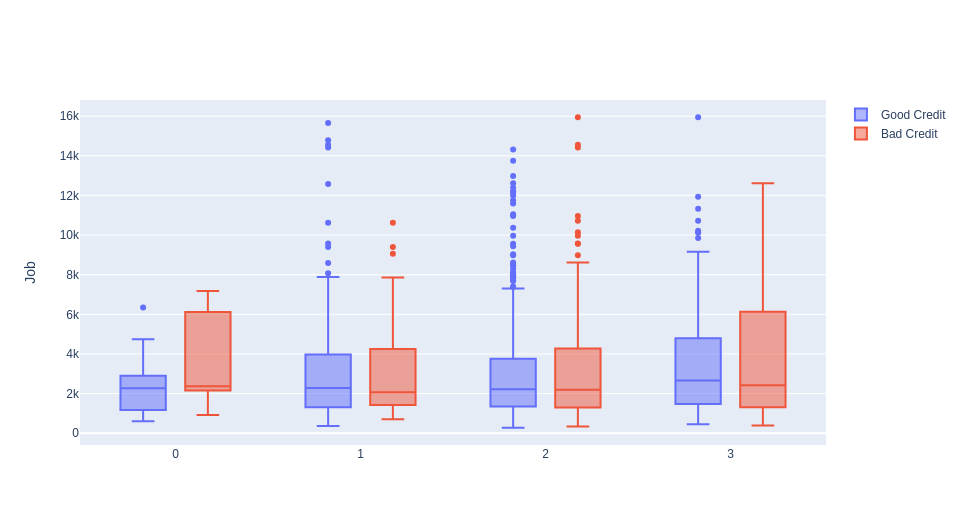

df_good = df.loc[df["Risk"] == 'good']['Job'].values.tolist()

df_bad = df.loc[df["Risk"] == 'bad']['Job'].values.tolist()

box_1 = go.Box(

x=df_good,

y=df['Credit amount'],

name="Good Credit"

)

box_2 = go.Box(

x=df_bad,

y=df['Credit amount'],

name="Bad Credit"

)

data = [box_1, box_2]

layout = go.Layout(

yaxis=dict(

title='Job'

),

boxmode='group'

)

fig = go.Figure(data=data, layout=layout)

py.iplot(fig, filename='box-age-cat')

Unskilled and non-residents with bad credit have more credit amount than others

Unskilled and non-residents with bad credit have more credit amount than others

Preprocessing#

df.dtypes

Unnamed: 0 int64

Age int64

Sex object

Job int64

Housing object

Saving accounts object

Checking account object

Credit amount int64

Duration int64

Purpose object

Risk object

dtype: object

df.isna().sum()

Unnamed: 0 0

Age 0

Sex 0

Job 0

Housing 0

Saving accounts 183

Checking account 394

Credit amount 0

Duration 0

Purpose 0

Risk 0

dtype: int64

We will use one-hot encoding for the sex, housing, and purpose variables.

one_hot = {

"Sex": "sex",

"Housing": "hous",

"Purpose": "purp"

}

And ordinal encoding for the others

ordinal_encoding = {

"Saving accounts": {

None: 0,

"little": 1,

"moderate": 2,

"quite rich": 3,

"rich": 4,

},

"Checking account": {

None: 0,

"little": 1,

"moderate": 2,

"rich": 3,

},

"Risk": {

"bad": 1,

"good": 0,

}

}

def one_hot_enconding(df, col_prefix: dict):

df = df.copy()

for col, prefix in col_prefix.items():

df = pd.get_dummies(data=df, prefix=prefix, columns=[col])

return df

def encode_ordinal(df, custom_ordinals: dict):

df = df.copy()

for col, map_dict in custom_ordinals.items():

df[col] = df[col].replace(map_dict)

return df

df_encode = df.copy()

df_encode = one_hot_enconding(df_encode, one_hot)

df_encode = encode_ordinal(df_encode, ordinal_encoding)

df_encode

| Unnamed: 0 | Age | Job | Saving accounts | Checking account | Credit amount | Duration | Risk | sex_female | sex_male | ... | hous_own | hous_rent | purp_business | purp_car | purp_domestic appliances | purp_education | purp_furniture/equipment | purp_radio/TV | purp_repairs | purp_vacation/others | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 67 | 2 | 0 | 1 | 1169 | 6 | 0 | 0 | 1 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 1 | 1 | 22 | 2 | 1 | 2 | 5951 | 48 | 1 | 1 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 2 | 2 | 49 | 1 | 1 | 0 | 2096 | 12 | 0 | 0 | 1 | ... | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 |

| 3 | 3 | 45 | 2 | 1 | 1 | 7882 | 42 | 0 | 0 | 1 | ... | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 4 | 4 | 53 | 2 | 1 | 1 | 4870 | 24 | 1 | 0 | 1 | ... | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 995 | 995 | 31 | 1 | 1 | 0 | 1736 | 12 | 0 | 1 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 996 | 996 | 40 | 3 | 1 | 1 | 3857 | 30 | 0 | 0 | 1 | ... | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

| 997 | 997 | 38 | 2 | 1 | 0 | 804 | 12 | 0 | 0 | 1 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 998 | 998 | 23 | 2 | 1 | 1 | 1845 | 45 | 1 | 0 | 1 | ... | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

| 999 | 999 | 27 | 2 | 2 | 2 | 4576 | 45 | 0 | 0 | 1 | ... | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 |

1000 rows × 21 columns

df_encode.dtypes

Unnamed: 0 int64

Age int64

Job int64

Saving accounts int64

Checking account int64

Credit amount int64

Duration int64

Risk int64

sex_female uint8

sex_male uint8

hous_free uint8

hous_own uint8

hous_rent uint8

purp_business uint8

purp_car uint8

purp_domestic appliances uint8

purp_education uint8

purp_furniture/equipment uint8

purp_radio/TV uint8

purp_repairs uint8

purp_vacation/others uint8

dtype: object

df_encode.isna().sum()

Unnamed: 0 0

Age 0

Job 0

Saving accounts 0

Checking account 0

Credit amount 0

Duration 0

Risk 0

sex_female 0

sex_male 0

hous_free 0

hous_own 0

hous_rent 0

purp_business 0

purp_car 0

purp_domestic appliances 0

purp_education 0

purp_furniture/equipment 0

purp_radio/TV 0

purp_repairs 0

purp_vacation/others 0

dtype: int64

# Check for duplicate rows

df.duplicated().sum()

0

df_encode.corr()['Risk'].sort_values()

hous_own -0.134589

purp_radio/TV -0.106922

Age -0.091127

sex_male -0.075493

Saving accounts -0.033871

purp_domestic appliances 0.008016

purp_repairs 0.020828

purp_furniture/equipment 0.020971

purp_car 0.022621

purp_vacation/others 0.028058

Job 0.032735

Unnamed: 0 0.034606

purp_business 0.036129

purp_education 0.049085

sex_female 0.075493

hous_free 0.081556

hous_rent 0.092785

Credit amount 0.154739

Checking account 0.197788

Duration 0.214927

Risk 1.000000

Name: Risk, dtype: float64

df_encode.columns

Index(['Unnamed: 0', 'Age', 'Job', 'Saving accounts', 'Checking account',

'Credit amount', 'Duration', 'Risk', 'sex_female', 'sex_male',

'hous_free', 'hous_own', 'hous_rent', 'purp_business', 'purp_car',

'purp_domestic appliances', 'purp_education',

'purp_furniture/equipment', 'purp_radio/TV', 'purp_repairs',

'purp_vacation/others'],

dtype='object')

Getting all the coluns that we are going to use in our model.

model_cols = ['Age', 'Job', 'Saving accounts', 'Checking account',

'Credit amount', 'Duration', 'sex_female', 'sex_male',

'hous_free', 'hous_own', 'hous_rent', 'purp_business', 'purp_car',

'purp_domestic appliances', 'purp_education',

'purp_furniture/equipment', 'purp_radio/TV', 'purp_repairs',

'purp_vacation/others']

df_encode.loc[df_encode['Risk']==0].mean()

Unnamed: 0 492.960000

Age 36.224286

Job 1.890000

Saving accounts 1.211429

Checking account 0.877143

Credit amount 2985.457143

Duration 19.207143

Risk 0.000000

sex_female 0.287143

sex_male 0.712857

hous_free 0.091429

hous_own 0.752857

hous_rent 0.155714

purp_business 0.090000

purp_car 0.330000

purp_domestic appliances 0.011429

purp_education 0.051429

purp_furniture/equipment 0.175714

purp_radio/TV 0.311429

purp_repairs 0.020000

purp_vacation/others 0.010000

dtype: float64

df_encode.loc[df_encode['Risk']==1].mean()

Unnamed: 0 514.760000

Age 33.963333

Job 1.936667

Saving accounts 1.140000

Checking account 1.290000

Credit amount 3938.126667

Duration 24.860000

Risk 1.000000

sex_female 0.363333

sex_male 0.636667

hous_free 0.146667

hous_own 0.620000

hous_rent 0.233333

purp_business 0.113333

purp_car 0.353333

purp_domestic appliances 0.013333

purp_education 0.076667

purp_furniture/equipment 0.193333

purp_radio/TV 0.206667

purp_repairs 0.026667

purp_vacation/others 0.016667

dtype: float64

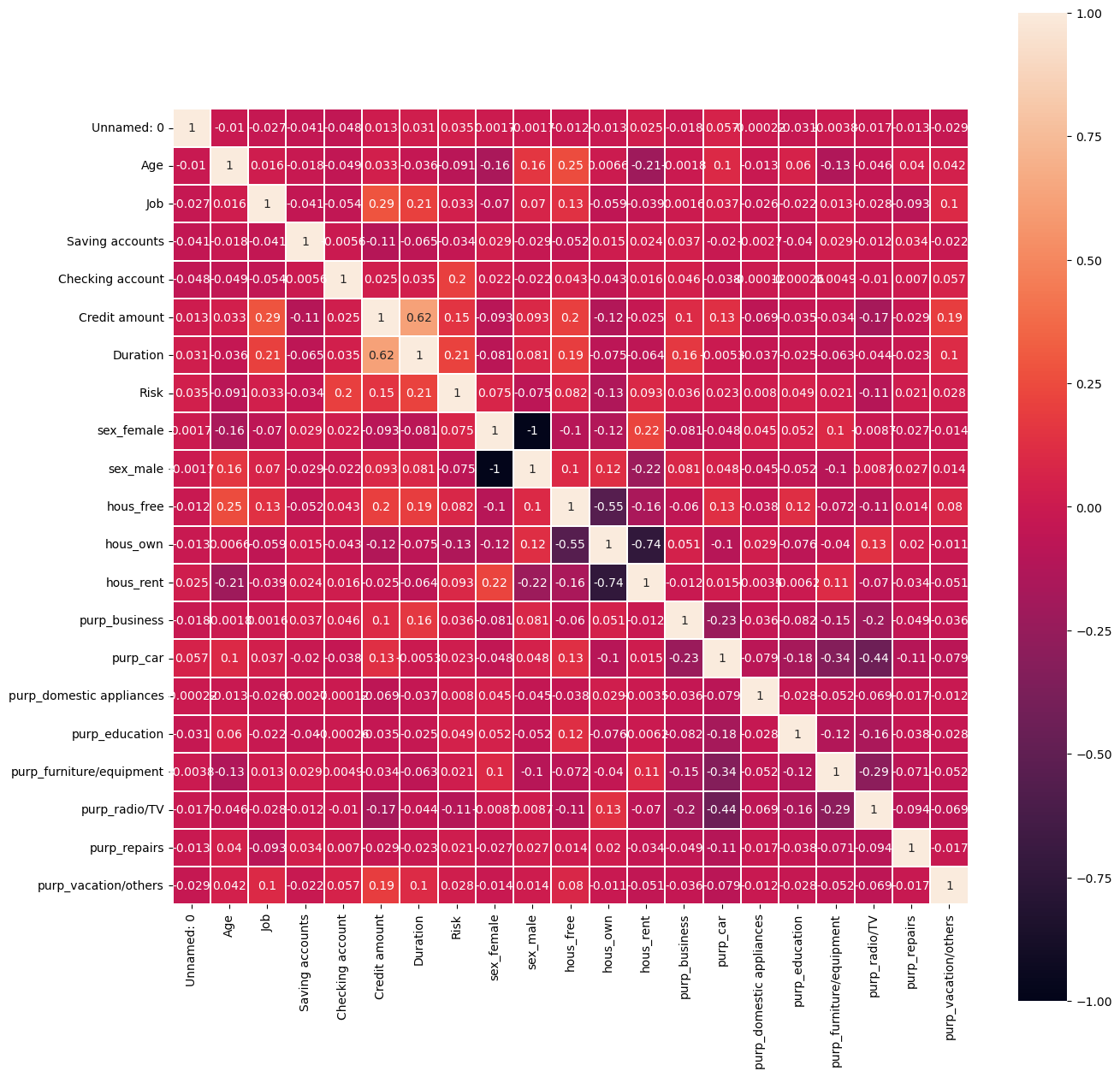

some correlation

df_encode.astype(float).corr().abs().sort_values(by='Risk',ascending=False)['Risk']

Risk 1.000000

Duration 0.214927

Checking account 0.197788

Credit amount 0.154739

hous_own 0.134589

purp_radio/TV 0.106922

hous_rent 0.092785

Age 0.091127

hous_free 0.081556

sex_female 0.075493

sex_male 0.075493

purp_education 0.049085

purp_business 0.036129

Unnamed: 0 0.034606

Saving accounts 0.033871

Job 0.032735

purp_vacation/others 0.028058

purp_car 0.022621

purp_furniture/equipment 0.020971

purp_repairs 0.020828

purp_domestic appliances 0.008016

Name: Risk, dtype: float64

Duration, checking account, credit amount, and owning house have the most Corr

plt.figure(figsize=(15,15))

sns.heatmap(df_encode.astype(float).corr(),linewidths=0.1,vmax=1.0,

square=True, linecolor='white', annot=True)

plt.show()

Training some Models#

X = df_encode.loc[:,model_cols]

y = df_encode.loc[:,'Risk']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)

X_train.shape, X_test.shape, y_train.shape, y_test.shape

((700, 19), (300, 19), (700,), (300,))

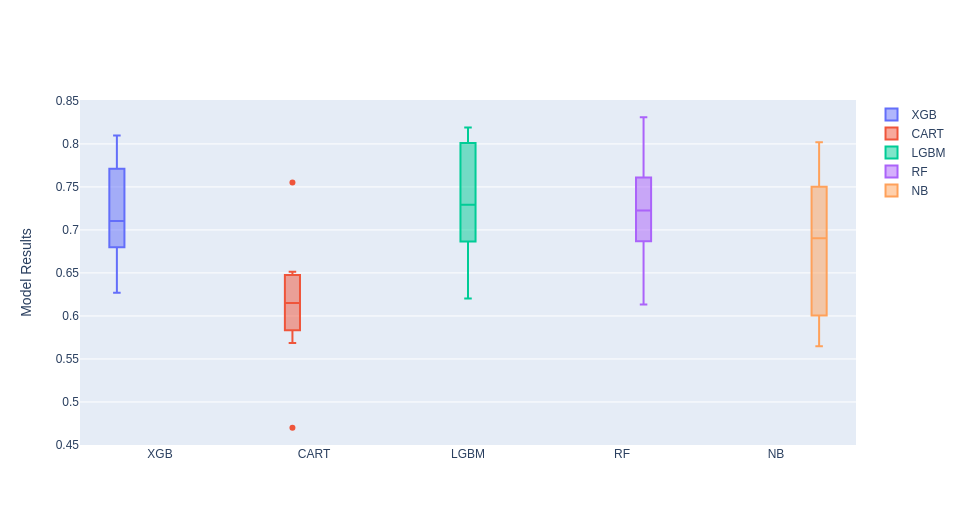

Here we are going to train 5 models

# prepare models

lgbmparameters = {'verbose': -1}

models = []

models.append(('XGB', XGBClassifier()))

models.append(('CART', DecisionTreeClassifier()))

models.append(('LGBM', LGBMClassifier(**lgbmparameters)))

models.append(('RF', RandomForestClassifier()))

models.append(('NB', GaussianNB()))

# evaluate each model in turn

results = []

names = []

scoring = 'roc_auc'

n_splits = 10

for name, model in models:

kfold = KFold(n_splits=n_splits)

cv_results = cross_val_score(model, X_train, y_train, cv=kfold, scoring=scoring)

results.append(cv_results)

names.append(name)

msg = "%s: %f (%f)" % (name, cv_results.mean(), cv_results.std())

print(msg)

XGB: 0.720764 (0.055151)

CART: 0.598842 (0.066576)

LGBM: 0.733702 (0.062989)

RF: 0.722074 (0.052949)

NB: 0.685554 (0.082030)

box_1 = go.Box(

x=n_splits*['XGB'],

y=results[0],

name="XGB"

)

box_2 = go.Box(

x=n_splits*['CART'],

y=results[1],

name="CART"

)

box_3 = go.Box(

x=n_splits*['LGBM'],

y=results[2],

name="LGBM"

)

box_4 = go.Box(

x=n_splits*['RF'],

y=results[3],

name="RF"

)

box_5 = go.Box(

x=n_splits*['NB'],

y=results[4],

name="NB"

)

data = [box_1, box_2, box_3, box_4, box_5]

layout = go.Layout(

yaxis=dict(

title='Model Results'

),

boxmode='group'

)

fig = go.Figure(data=data, layout=layout)

py.iplot(fig, filename='box-age-cat')

The best models were RandomForest and LGBM, we are going to train this model and use Optuna for hyperparameter optimization.

lgbm_model = LGBMClassifier(**lgbmparameters).fit(X_train, y_train)

y_prob_lgbm = lgbm_model.predict_proba(X_test)

print('For the LGBM Model, the test AUC is: '+str(roc_auc_score(y_test,y_prob_lgbm[:,1])))

print('For the LGBM Model, the test Accu is: '+ str(accuracy_score(y_test,y_prob_lgbm[:,1].round())))

For the LGBM Model, the test AUC is: 0.7434670592565329

For the LGBM Model, the test Accu is: 0.7533333333333333

rf_model = RandomForestClassifier().fit(X_train, y_train)

y_prob_rf = rf_model.predict_proba(X_test)

print('For the RandomForest Model, the test AUC is: '+str(roc_auc_score(y_test,y_prob_rf[:,1])))

print('For the RandomForest Model, the test Accu is: '+ str(accuracy_score(y_test,y_prob_rf[:,1].round())))

For the RandomForest Model, the test AUC is: 0.7218308007781692

For the RandomForest Model, the test Accu is: 0.7266666666666667

Hyperparameter Optimization using Optuna#

def auc_ks_metric(y_test, y_prob):

'''

Input:

y_prob: model predict prob

y_test: target

Output: Metrics of validation

auc, ks (Kolmogorov-Smirnov)

'''

fpr, tpr, thresholds = metrics.roc_curve(y_test, y_prob)

auc = metrics.auc(fpr, tpr)

ks = max(tpr - fpr)

return auc, ks

def objective(trial, X_train, y_train, X_test, y_test, balanced, method):

'''

Input:

trial: trial of the test

X_train:

y_train:

X_test:

y_test:

balanced:balanced or None

method: XGBoost, CatBoost or LGBM

Output: Metrics of validation

auc, ks, log_loss

auc_logloss_ks(y_test, y_pred)[0]

'''

gc.collect()

if method=='LGBM':

param_grid = {'learning_rate': trial.suggest_float('learning_rate', 0.0001, 0.1, log=True),

'num_leaves': trial.suggest_int('num_leaves', 2, 256),

'lambda_l1': trial.suggest_float("lambda_l1", 1e-8, 10.0, log=True),

'lambda_l2': trial.suggest_float("lambda_l2", 1e-8, 10.0, log=True),

'min_data_in_leaf': trial.suggest_int('min_data_in_leaf', 5, 100),

'max_depth': trial.suggest_int('max_depth', 5, 64),

'feature_fraction': trial.suggest_float("feature_fraction", 0.4, 1.0),

'bagging_fraction': trial.suggest_float("bagging_fraction", 0.4, 1.0),

'bagging_freq': trial.suggest_int("bagging_freq", 1, 7),

'verbose': -1

}

model = LGBMClassifier(**param_grid,tree_method='gpu_hist',gpu_id=0)

print('LGBM - Optimization using optuna')

model.fit(X_train, y_train)

y_pred = model.predict_proba(X_test)[:,1]

if method=='RF':

param_grid = {

'max_features': trial.suggest_int('max_features', 4, 20),

'min_samples_leaf': trial.suggest_int('min_samples_leaf', 2, 25),

'max_depth': trial.suggest_int('max_depth', 5, 64),

'min_samples_split': trial.suggest_int("min_samples_split", 2, 30),

'n_estimators': trial.suggest_int("n_estimators", 100, 2000)

}

model = RandomForestClassifier(**param_grid)

print('RandomForest - Optimization using optuna')

model.fit(X_train, y_train)

y_pred = model.predict_proba(X_test)[:,1]

if method=='XGBoost':

param_grid = {'learning_rate': trial.suggest_float('learning_rate', 0.0001, 0.1, log=True),

'max_depth': trial.suggest_int('max_depth', 3, 16),

'min_child_weight': trial.suggest_int('min_child_weight', 1, 300),

'gamma': trial.suggest_float('gamma', 1e-8, 1.0, log = True),

'alpha': trial.suggest_float('alpha', 1e-8, 1.0, log = True),

'lambda': trial.suggest_float('lambda', 0.0001, 10.0, log = True),

'colsample_bytree': trial.suggest_float('colsample_bytree', 0.1, 0.8),

'booster': 'gbtree',

'random_state': 42,

}

model = XGBClassifier(**param_grid,tree_method='gpu_hist',gpu_id=0)

print('XGBoost - Optimization using optuna')

model.fit(X_train, y_train,verbose=False)

y_pred = model.predict_proba(X_test)[:,1]

auc_res = auc_ks_metric(y_test, y_pred)[0]

print('auc:'+str(auc_res))

return auc_ks_metric(y_test, y_pred)[0]

def tuning(X_train, y_train, X_test, y_test, balanced, method):

'''

Input:

trial:

x_train:

y_train:

X_test:

y_test:

balanced:balanced or not balanced

method: XGBoost, CatBoost or LGBM

Output: Metrics of validation

auc, ks, log_loss

auc_logloss_ks(y_test, y_pred)[0]

'''

study = optuna.create_study(direction='maximize', study_name=method+' Classifier')

func = lambda trial: objective(trial, X_train, y_train, X_test, y_test, balanced, method)

print('Starting the optimization')

time_max_tuning = 60*30 # max time in seconds to stop

study.optimize(func, timeout=time_max_tuning)

return study

def train(X_train, y_train, X_test, y_test, balanced, method):

'''

Input:

X_train:

y_train:

X_test:

y_test:

balanced:balanced or None

method: XGBoost, CatBoost or LGBM

Output: predict model

'''

print('Tuning')

study = tuning(X_train, y_train, X_test, y_test, balanced, method)

if method=='LGBM':

model = LGBMClassifier(**study.best_params)

print('Last Fit')

model.fit(X_train, y_train, eval_set=[(X_test,y_test)],

callbacks = [lightgbm.early_stopping(stopping_rounds=100), lightgbm.log_evaluation(period=5000)])

if method=='XGBoost':

model = XGBClassifier(**study.best_params)

print('Last Fit')

model.fit(X_train, y_train, eval_set=[(X_test,y_test)],

early_stopping_rounds=100,verbose = False)

if method=='RF':

model = RandomForestClassifier(**study.best_params)

print('Last Fit')

model.fit(X_train, y_train)

return model, study

lgbm_model, study_lgbm = train(X_train, y_train, X_test, y_test, balanced='balanced', method='LGBM')

[I 2023-09-25 07:48:59,504] A new study created in memory with name: LGBM Classifier

[I 2023-09-25 07:48:59,607] Trial 0 finished with value: 0.7707818497292181 and parameters: {'learning_rate': 0.04564317750022488, 'num_leaves': 254, 'lambda_l1': 0.17602474289716696, 'lambda_l2': 2.936736356867574, 'min_data_in_leaf': 92, 'max_depth': 41, 'feature_fraction': 0.630771183128692, 'bagging_fraction': 0.8791863972428846, 'bagging_freq': 5}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 07:48:59,695] Trial 1 finished with value: 0.7673905042326096 and parameters: {'learning_rate': 0.03163545356039165, 'num_leaves': 93, 'lambda_l1': 5.331694642994698e-07, 'lambda_l2': 0.0016117988828970487, 'min_data_in_leaf': 62, 'max_depth': 17, 'feature_fraction': 0.5207793700543741, 'bagging_fraction': 0.6988688771949946, 'bagging_freq': 2}. Best is trial 0 with value: 0.7707818497292181.

Tuning

Starting the optimization

LGBM - Optimization using optuna

auc:0.7707818497292181

LGBM - Optimization using optuna

auc:0.7673905042326096

LGBM - Optimization using optuna

[I 2023-09-25 07:48:59,778] Trial 2 finished with value: 0.7639202902360797 and parameters: {'learning_rate': 0.00032903168736575527, 'num_leaves': 221, 'lambda_l1': 0.013182095631109458, 'lambda_l2': 0.004903360053701577, 'min_data_in_leaf': 50, 'max_depth': 35, 'feature_fraction': 0.81375010947157, 'bagging_fraction': 0.47255383236900694, 'bagging_freq': 6}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 07:48:59,870] Trial 3 finished with value: 0.7488301172511699 and parameters: {'learning_rate': 0.07583419812542502, 'num_leaves': 227, 'lambda_l1': 0.001263229821256988, 'lambda_l2': 0.6714031923624736, 'min_data_in_leaf': 23, 'max_depth': 48, 'feature_fraction': 0.47371647441012454, 'bagging_fraction': 0.5357410570154348, 'bagging_freq': 3}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 07:48:59,958] Trial 4 finished with value: 0.7586361007413639 and parameters: {'learning_rate': 0.0001610953746996855, 'num_leaves': 228, 'lambda_l1': 4.74483283120879, 'lambda_l2': 0.00011656154418021165, 'min_data_in_leaf': 88, 'max_depth': 60, 'feature_fraction': 0.5768682497889083, 'bagging_fraction': 0.9363888441877074, 'bagging_freq': 5}. Best is trial 0 with value: 0.7707818497292181.

auc:0.7639202902360797

LGBM - Optimization using optuna

auc:0.7488301172511699

LGBM - Optimization using optuna

auc:0.7586361007413639

LGBM - Optimization using optuna

[I 2023-09-25 07:49:00,049] Trial 5 finished with value: 0.7586098112413902 and parameters: {'learning_rate': 0.0001249838804070837, 'num_leaves': 62, 'lambda_l1': 1.0950722639611093e-08, 'lambda_l2': 1.6247452419757427, 'min_data_in_leaf': 88, 'max_depth': 20, 'feature_fraction': 0.7390198578425595, 'bagging_fraction': 0.5451921961124094, 'bagging_freq': 4}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 07:49:00,135] Trial 6 finished with value: 0.7462274567537727 and parameters: {'learning_rate': 0.021165567217590234, 'num_leaves': 219, 'lambda_l1': 2.634681758289909e-06, 'lambda_l2': 2.1170808617536877e-06, 'min_data_in_leaf': 70, 'max_depth': 52, 'feature_fraction': 0.8886838094462373, 'bagging_fraction': 0.7972849312237408, 'bagging_freq': 5}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 07:49:00,229] Trial 7 finished with value: 0.7455702192544299 and parameters: {'learning_rate': 0.028054358171711414, 'num_leaves': 106, 'lambda_l1': 0.2794244438193041, 'lambda_l2': 0.02038032703976737, 'min_data_in_leaf': 41, 'max_depth': 8, 'feature_fraction': 0.9320015422653435, 'bagging_fraction': 0.97584085801718, 'bagging_freq': 1}. Best is trial 0 with value: 0.7707818497292181.

[I 2023-09-25 08:18:59,736] Trial 5841 finished with value: 0.7210946947789053 and parameters: {'learning_rate': 0.0017454581670019865, 'num_leaves': 71, 'lambda_l1': 0.00030822208833371846, 'lambda_l2': 0.001178948478008598, 'min_data_in_leaf': 82, 'max_depth': 64, 'feature_fraction': 0.9975320930746641, 'bagging_fraction': 0.9612726835980929, 'bagging_freq': 1}. Best is trial 3444 with value: 0.7828487302171513.

LGBM - Optimization using optuna

auc:0.7210946947789053

Last Fit

y_prob_lgbm = lgbm_model.predict_proba(X_test)

[LightGBM] [Warning] min_data_in_leaf is set=81, min_child_samples=20 will be ignored. Current value: min_data_in_leaf=81

[LightGBM] [Warning] feature_fraction is set=0.5174527298564775, colsample_bytree=1.0 will be ignored. Current value: feature_fraction=0.5174527298564775

[LightGBM] [Warning] lambda_l2 is set=0.0003124668197733085, reg_lambda=0.0 will be ignored. Current value: lambda_l2=0.0003124668197733085

[LightGBM] [Warning] lambda_l1 is set=2.524882043205203e-06, reg_alpha=0.0 will be ignored. Current value: lambda_l1=2.524882043205203e-06

[LightGBM] [Warning] bagging_fraction is set=0.7962210156422196, subsample=1.0 will be ignored. Current value: bagging_fraction=0.7962210156422196

[LightGBM] [Warning] bagging_freq is set=1, subsample_freq=0 will be ignored. Current value: bagging_freq=1

print('For the LGBM Model, the test AUC is: '+str(roc_auc_score(y_test,y_prob_lgbm[:,1])))

print('For the LGBM Model, the KS is: '+str(auc_ks_metric(y_test,y_prob_lgbm[:,1])[1]))

print('For the LGBM Model, the test Accu is: '+ str(accuracy_score(y_test,y_prob_lgbm[:,1].round())))

For the LGBM Model, the test AUC is: 0.7828487302171513

For the LGBM Model, the KS is: 0.4945580735054419

For the LGBM Model, the test Accu is: 0.7133333333333334

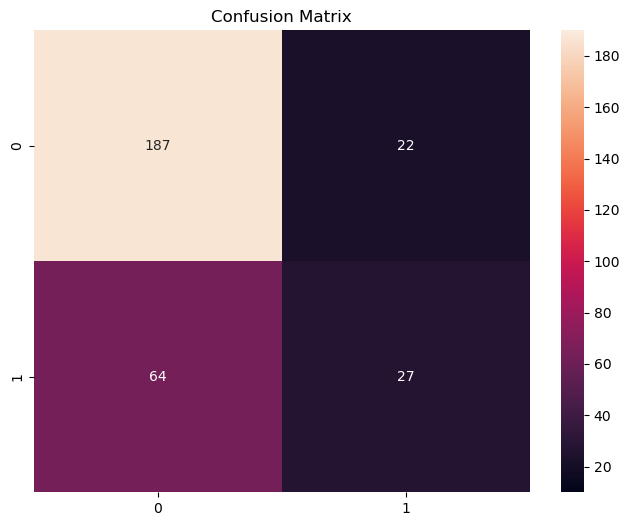

confusion_hard = confusion_matrix(y_test, y_prob_lgbm[:,1].round())

plt.figure(figsize=(8, 6))

ax = sns.heatmap(confusion_hard, vmin=10, vmax=190,annot = True, fmt='d')

ax.set_title('Confusion Matrix')

Confusion Matrix in LGBM

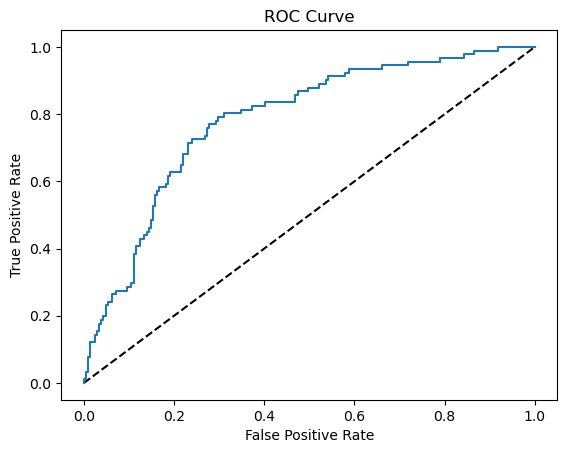

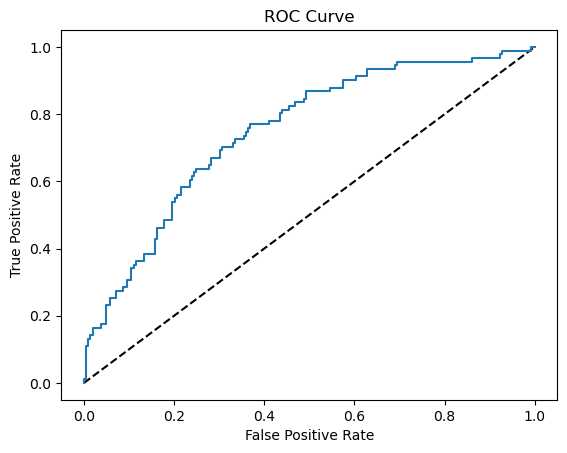

# Generate ROC curve values: fpr, tpr, thresholds

fpr, tpr, thresholds = sklearn.metrics.roc_curve(y_test, y_prob_lgbm[:,1])

# Plot ROC curve

plt.plot([0, 1], [0, 1], 'k--')

plt.plot(fpr, tpr)

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.title('ROC Curve')

plt.show()

optuna.visualization.plot_param_importances(study_lgbm)

rf_model, study_rf = train(X_train, y_train, X_test, y_test, balanced='balanced', method='RF')

[I 2023-09-25 08:32:34,955] A new study created in memory with name: RF Classifier

Tuning

Starting the optimization

RandomForest - Optimization using optuna

[I 2023-09-25 08:32:35,237] Trial 0 finished with value: 0.7599768652400232 and parameters: {'max_features': 7, 'min_samples_leaf': 21, 'max_depth': 25, 'min_samples_split': 24, 'n_estimators': 231}. Best is trial 0 with value: 0.7599768652400232.

auc:0.7599768652400232

RandomForest - Optimization using optuna

[I 2023-09-25 08:32:36,115] Trial 1 finished with value: 0.7550344392449656 and parameters: {'max_features': 6, 'min_samples_leaf': 25, 'max_depth': 63, 'min_samples_split': 27, 'n_estimators': 1132}. Best is trial 0 with value: 0.7599768652400232.

Last Fit

y_prob_rf = rf_model.predict_proba(X_test)

print('For the RandomForest Model, the test AUC is: '+str(roc_auc_score(y_test,y_prob_rf[:,1])))

print('For the RandomForest, the KS is: '+str(auc_ks_metric(y_test,y_prob_rf[:,1])[1]))

print('For the RandomForest Model, the test Accu is: '+ str(accuracy_score(y_test,y_prob_rf[:,1].round())))

For the RandomForest Model, the test AUC is: 0.7489352752510646

For the RandomForest, the KS is: 0.40080971659919035

For the RandomForest Model, the test Accu is: 0.7233333333333334

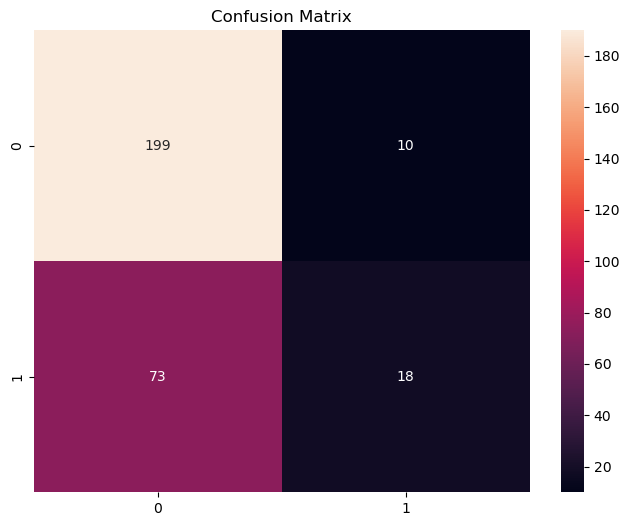

confusion_hard = confusion_matrix(y_test, y_prob_rf[:,1].round())

plt.figure(figsize=(8, 6))

ax = sns.heatmap(confusion_hard, vmin=10, vmax=190,annot = True, fmt='d')

ax.set_title('Confusion Matrix')

Confusion Matrix in RandomForest

# Generate ROC curve values: fpr, tpr, thresholds

fpr, tpr, thresholds = sklearn.metrics.roc_curve(y_test, y_prob_rf[:,1])

# Plot ROC curve

plt.plot([0, 1], [0, 1], 'k--')

plt.plot(fpr, tpr)

plt.xlabel('False Positive Rate')

plt.ylabel('True Positive Rate')

plt.title('ROC Curve')

plt.show()

LGBM model has a better performance after the optimization using Optuna, so we’ll this model as our final model.

Ranking the final model#

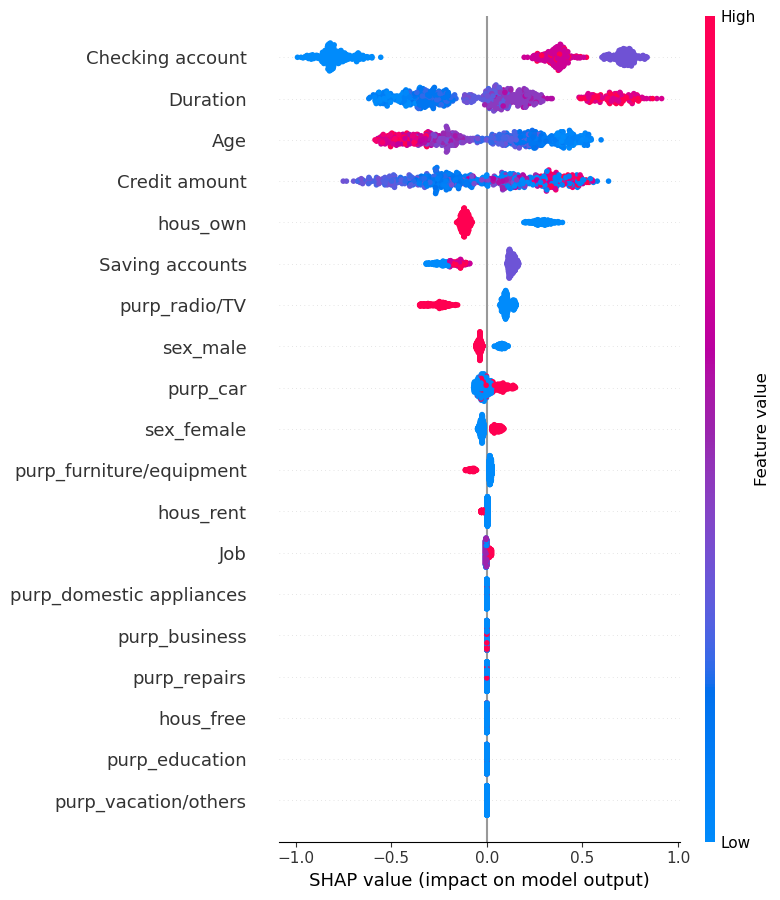

import shap

explainer = shap.TreeExplainer(lgbm_model)

shap_values = explainer.shap_values(X_train)

shap.summary_plot(shap_values[1], X_train,show=False)

SHAP results in LGBM

df_test = pd.concat([X_test, y_test],axis=1)

shap_test = explainer.shap_values(X_test)

LightGBM binary classifier with TreeExplainer shap values output has changed to a list of ndarray

Here we are going to create new variables from shap. The goal is to make more easier to use our final model, for example we want to select the clients with high scores and have more cash in their checking account

def shap_col(shap_):

col = ['Age', 'Job', 'Saving accounts', 'Checking account', 'Credit amount',

'Duration', 'sex_female', 'sex_male', 'hous_free', 'hous_own',

'hous_rent', 'purp_business', 'purp_car', 'purp_domestic appliances',

'purp_education', 'purp_furniture/equipment', 'purp_radio/TV',

'purp_repairs', 'purp_vacation/others']

df_shap = pd.DataFrame(shap_test[1],columns=col)

# shap_cols = {}

# shap_cols['shap_1'] = np.nan

# shap_cols['shap_2'] = np.nan

# shap_cols['shap_3'] = np.nan

# shap_cols['shap_4'] = np.nan

# shap_cols['shap_5'] = np.nan

# shap_cols['shap_6'] = np.nan

df_shap.loc[df_shap['Checking account']>0.2, 'shap_1'] = 'Little Check Account'

df_shap.loc[df_shap['Duration']>0.2, 'shap_2'] = 'More Credit Duration'

df_shap.loc[df_shap['Credit amount']>0.2, 'shap_3'] = 'More Credit Amount'

df_shap.loc[df_shap['Age']>0.2, 'shap_4'] = 'More Junior Client'

df_shap.loc[df_shap['hous_own']>0.2, 'shap_5'] = 'Have House'

df_shap.loc[df_shap['purp_radio/TV']>0.2, 'shap_6'] = 'The purpose is to buy Radio/TV'

df_shap.loc[df_shap['Checking account']<-0.2, 'shap_7'] = 'Moderate/Rich Check Account'

df_shap.loc[df_shap['Duration']<-0.2, 'shap_8'] = 'Less Credit Duration'

df_shap.loc[df_shap['Credit amount']<-0.2, 'shap_9'] = 'Less Credit Amount'

df_shap.loc[df_shap['Age']<-0.2, 'shap_10'] = 'More Senior Client'

df_shap.loc[df_shap['hous_own']<-0.2, 'shap_11'] = 'Does not have House'

# pd.DataFrame(shap_test[1],columns=col).apply(shap_col, axis=1, result_type='expand')

return df_shap[['shap_1','shap_2','shap_3','shap_4','shap_5','shap_6',

'shap_7','shap_8','shap_9','shap_10','shap_11']]

df_shap_arg = pd.DataFrame(shap_col(shap_test[1]))

df_shap_arg

| shap_1 | shap_2 | shap_3 | shap_4 | shap_5 | shap_6 | shap_7 | shap_8 | shap_9 | shap_10 | shap_11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | Little Check Account | NaN | NaN | More Junior Client | NaN | NaN | NaN | NaN | Less Credit Amount | NaN | NaN |

| 1 | Little Check Account | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | Little Check Account | More Credit Duration | NaN | NaN | NaN | NaN | NaN | NaN | Less Credit Amount | NaN | NaN |

| 3 | Little Check Account | NaN | More Credit Amount | More Junior Client | Have House | NaN | NaN | Less Credit Duration | NaN | NaN | NaN |

| 4 | NaN | NaN | More Credit Amount | NaN | NaN | NaN | Moderate/Rich Check Account | NaN | NaN | More Senior Client | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 295 | NaN | NaN | NaN | More Junior Client | NaN | NaN | Moderate/Rich Check Account | NaN | Less Credit Amount | NaN | NaN |

| 296 | Little Check Account | More Credit Duration | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 297 | NaN | NaN | More Credit Amount | More Junior Client | NaN | NaN | Moderate/Rich Check Account | Less Credit Duration | NaN | NaN | NaN |

| 298 | Little Check Account | More Credit Duration | More Credit Amount | NaN | Have House | NaN | NaN | NaN | NaN | NaN | NaN |

| 299 | Little Check Account | NaN | More Credit Amount | More Junior Client | Have House | NaN | NaN | Less Credit Duration | NaN | NaN | NaN |

300 rows × 11 columns

df_final = pd.concat([df_test.reset_index() ,df_shap_arg],axis=1)

df_final

| index | Age | Job | Saving accounts | Checking account | Credit amount | Duration | sex_female | sex_male | hous_free | ... | shap_2 | shap_3 | shap_4 | shap_5 | shap_6 | shap_7 | shap_8 | shap_9 | shap_10 | shap_11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 521 | 24 | 2 | 1 | 1 | 3190 | 18 | 1 | 0 | 0 | ... | NaN | NaN | More Junior Client | NaN | NaN | NaN | NaN | Less Credit Amount | NaN | NaN |

| 1 | 737 | 35 | 1 | 2 | 1 | 4380 | 18 | 0 | 1 | 0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | 740 | 32 | 2 | 2 | 1 | 2325 | 24 | 0 | 1 | 0 | ... | More Credit Duration | NaN | NaN | NaN | NaN | NaN | NaN | Less Credit Amount | NaN | NaN |

| 3 | 660 | 23 | 2 | 1 | 3 | 1297 | 12 | 0 | 1 | 0 | ... | NaN | More Credit Amount | More Junior Client | Have House | NaN | NaN | Less Credit Duration | NaN | NaN | NaN |

| 4 | 411 | 35 | 3 | 1 | 0 | 7253 | 33 | 0 | 1 | 0 | ... | NaN | More Credit Amount | NaN | NaN | NaN | Moderate/Rich Check Account | NaN | NaN | More Senior Client | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 295 | 468 | 26 | 2 | 1 | 0 | 2764 | 33 | 1 | 0 | 0 | ... | NaN | NaN | More Junior Client | NaN | NaN | Moderate/Rich Check Account | NaN | Less Credit Amount | NaN | NaN |

| 296 | 935 | 30 | 3 | 2 | 2 | 1919 | 30 | 0 | 1 | 0 | ... | More Credit Duration | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 297 | 428 | 20 | 2 | 1 | 0 | 1313 | 9 | 0 | 1 | 0 | ... | NaN | More Credit Amount | More Junior Client | NaN | NaN | Moderate/Rich Check Account | Less Credit Duration | NaN | NaN | NaN |

| 298 | 7 | 35 | 3 | 1 | 2 | 6948 | 36 | 0 | 1 | 0 | ... | More Credit Duration | More Credit Amount | NaN | Have House | NaN | NaN | NaN | NaN | NaN | NaN |

| 299 | 155 | 20 | 2 | 1 | 1 | 1282 | 12 | 1 | 0 | 0 | ... | NaN | More Credit Amount | More Junior Client | Have House | NaN | NaN | Less Credit Duration | NaN | NaN | NaN |

300 rows × 32 columns

df_final = df_final.fillna(0)

creating a column score from our predeict_proba

df_final['score'] = y_prob_lgbm[:,1]

we will divide our clients into 5 groups based on the score, this number we can use any number to see if our model is ordering some variables

df_final['rank'] = pd.qcut(df_final['score'], 5,labels = False)

Group by some variables

df_final.groupby('rank')[['Checking account','Duration', 'Age','Credit amount', 'hous_own',

'Saving accounts','purp_radio/TV','purp_car','sex_male','sex_female']].agg('mean')

| Checking account | Duration | Age | Credit amount | hous_own | Saving accounts | purp_radio/TV | purp_car | sex_male | sex_female | |

|---|---|---|---|---|---|---|---|---|---|---|

| rank | ||||||||||

| 0 | 0.083333 | 15.350000 | 41.300000 | 2261.750000 | 0.900000 | 1.183333 | 0.400000 | 0.300000 | 0.766667 | 0.233333 |

| 1 | 0.716667 | 16.266667 | 35.266667 | 2352.266667 | 0.783333 | 1.283333 | 0.216667 | 0.266667 | 0.766667 | 0.233333 |

| 2 | 1.216667 | 18.566667 | 36.950000 | 3140.466667 | 0.766667 | 1.033333 | 0.250000 | 0.300000 | 0.683333 | 0.316667 |

| 3 | 1.450000 | 18.466667 | 33.133333 | 2666.100000 | 0.683333 | 1.283333 | 0.266667 | 0.383333 | 0.716667 | 0.283333 |

| 4 | 1.383333 | 31.783333 | 31.700000 | 4354.200000 | 0.383333 | 1.033333 | 0.166667 | 0.333333 | 0.600000 | 0.400000 |

df_final.groupby('rank')[['Checking account','Duration', 'Age','Credit amount', 'hous_own',

'Saving accounts','purp_radio/TV','purp_car','sex_male','sex_female']].agg('mean').style.bar(align='mid', color=['#d65f5f', '#5fba7d'])

| Checking account | Duration | Age | Credit amount | hous_own | Saving accounts | purp_radio/TV | purp_car | sex_male | sex_female | |

|---|---|---|---|---|---|---|---|---|---|---|

| rank | ||||||||||

| 0 | 0.083333 | 15.350000 | 41.300000 | 2261.750000 | 0.900000 | 1.183333 | 0.400000 | 0.300000 | 0.766667 | 0.233333 |

| 1 | 0.716667 | 16.266667 | 35.266667 | 2352.266667 | 0.783333 | 1.283333 | 0.216667 | 0.266667 | 0.766667 | 0.233333 |

| 2 | 1.216667 | 18.566667 | 36.950000 | 3140.466667 | 0.766667 | 1.033333 | 0.250000 | 0.300000 | 0.683333 | 0.316667 |

| 3 | 1.450000 | 18.466667 | 33.133333 | 2666.100000 | 0.683333 | 1.283333 | 0.266667 | 0.383333 | 0.716667 | 0.283333 |

| 4 | 1.383333 | 31.783333 | 31.700000 | 4354.200000 | 0.383333 | 1.033333 | 0.166667 | 0.333333 | 0.600000 | 0.400000 |

We managed to create a good discrimination between our audience with higher scores and those with lower scores

df_final.groupby('rank')[['Risk']].agg('sum').style.bar(align='mid', color=['#d65f5f', '#5fba7d'])

| Risk | |

|---|---|

| rank | |

| 0 | 4 |

| 1 | 8 |

| 2 | 13 |

| 3 | 30 |

| 4 | 36 |

We were able to order the amount of bad credit

we can see using other’s numbers to divide

df_final['rank'] = pd.qcut(df_final['score'], 3,labels = False)

df_final.groupby('rank')[['Checking account','Duration', 'Age','Credit amount', 'hous_own',

'Saving accounts','purp_radio/TV','purp_car','sex_male','sex_female']].agg('mean')

| Checking account | Duration | Age | Credit amount | hous_own | Saving accounts | purp_radio/TV | purp_car | sex_male | sex_female | |

|---|---|---|---|---|---|---|---|---|---|---|

| rank | ||||||||||

| 0 | 0.31 | 15.43 | 39.69 | 2282.97 | 0.86 | 1.17 | 0.36 | 0.28 | 0.77 | 0.23 |

| 1 | 1.17 | 18.19 | 35.30 | 2868.43 | 0.77 | 1.18 | 0.20 | 0.31 | 0.71 | 0.29 |

| 2 | 1.43 | 26.64 | 32.02 | 3713.47 | 0.48 | 1.14 | 0.22 | 0.36 | 0.64 | 0.36 |

df_final.groupby('rank')[['Checking account','Duration', 'Age','Credit amount', 'hous_own',

'Saving accounts','purp_radio/TV','purp_car','sex_male','sex_female']].agg('mean').style.bar(align='mid', color=['#d65f5f', '#5fba7d'])

| Checking account | Duration | Age | Credit amount | hous_own | Saving accounts | purp_radio/TV | purp_car | sex_male | sex_female | |

|---|---|---|---|---|---|---|---|---|---|---|

| rank | ||||||||||

| 0 | 0.310000 | 15.430000 | 39.690000 | 2282.970000 | 0.860000 | 1.170000 | 0.360000 | 0.280000 | 0.770000 | 0.230000 |

| 1 | 1.170000 | 18.190000 | 35.300000 | 2868.430000 | 0.770000 | 1.180000 | 0.200000 | 0.310000 | 0.710000 | 0.290000 |

| 2 | 1.430000 | 26.640000 | 32.020000 | 3713.470000 | 0.480000 | 1.140000 | 0.220000 | 0.360000 | 0.640000 | 0.360000 |

df_final.groupby('rank')[['Risk']].agg('sum').style.bar(align='mid', color=['#d65f5f', '#5fba7d'])

| Risk | |

|---|---|

| rank | |

| 0 | 8 |

| 1 | 26 |

| 2 | 57 |

Our final model is:

df_final[['score','rank','shap_1','shap_2','shap_3','shap_4','shap_5','shap_6',

'shap_7','shap_8','shap_9','shap_10','shap_11']]

| score | rank | shap_1 | shap_2 | shap_3 | shap_4 | shap_5 | shap_6 | shap_7 | shap_8 | shap_9 | shap_10 | shap_11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.344688 | 2 | Little Check Account | 0 | 0 | More Junior Client | 0 | 0 | 0 | 0 | Less Credit Amount | 0 | 0 |

| 1 | 0.296853 | 1 | Little Check Account | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0.410630 | 2 | Little Check Account | More Credit Duration | 0 | 0 | 0 | 0 | 0 | 0 | Less Credit Amount | 0 | 0 |

| 3 | 0.427560 | 2 | Little Check Account | 0 | More Credit Amount | More Junior Client | Have House | 0 | 0 | Less Credit Duration | 0 | 0 | 0 |

| 4 | 0.184806 | 1 | 0 | 0 | More Credit Amount | 0 | 0 | 0 | Moderate/Rich Check Account | 0 | 0 | More Senior Client | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 295 | 0.187536 | 1 | 0 | 0 | 0 | More Junior Client | 0 | 0 | Moderate/Rich Check Account | 0 | Less Credit Amount | 0 | 0 |

| 296 | 0.245917 | 1 | Little Check Account | More Credit Duration | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 297 | 0.167448 | 1 | 0 | 0 | More Credit Amount | More Junior Client | 0 | 0 | Moderate/Rich Check Account | Less Credit Duration | 0 | 0 | 0 |

| 298 | 0.658138 | 2 | Little Check Account | More Credit Duration | More Credit Amount | 0 | Have House | 0 | 0 | 0 | 0 | 0 | 0 |

| 299 | 0.651962 | 2 | Little Check Account | 0 | More Credit Amount | More Junior Client | Have House | 0 | 0 | Less Credit Duration | 0 | 0 | 0 |

300 rows × 13 columns